In southeast Connecticut, the car dealership Cardinal Honda is something of an institution. As a kid, I remember seeing the founder Stanley Cardinal on TV with his slicked-back hair imploring people to “Fly with a Cardinal at the wheel of a Honda!” — a jingle that still played in my head decades later when I visited Cardinal Honda for the first time.

In late January, Cardinal Honda sold me a new Honda Fit after several days of wheeling and dealing. The people were nice enough, but the experience reinforced the stereotype of car salesmen being somewhat shady, misleading characters who will cajole, caress and say anything to get the sale. I was on high alert for how the dealership treated me because I am currently taking a graduate class at Columbia Business School called “Managerial Negotiations,” which is about the art and tactics of dealmaking in a way that is efficient and amicable.

Based on my time with Cardinal Honda, they did not exactly score an A.

On a Thursday morning, I met my dad at Cardinal Honda, where over the past years he had already purchased a Honda Ridgeline truck and — just the previous month — my mom’s 2016 Honda Fit. My dad might be among the few people who likes going to car dealerships to check out cars and ham it up with the salesmen. He introduced me to one named Peter.

My bargaining chip in the negotiations was a 2001 Subaru Forester, which had nearly 300,000 miles on it. My parents had passed me the old car as a Christmas gift, but it imminently needed about $1000 of work. Rather than investing in that ancient vehicle — which seemed more and more prone to breaking down — I thought it made sense to try to trade it in for a new car. As Cardinal Honda was advertising an incredibly low interest rate of 0.9 percent on new cars, the stars seemed to be aligning.

After introductions, Peter had another worker assess the Subaru. They came back and said it was worth a total trade-in value of $90. Nine Zero. Total. I thought the Subaru might sell for $500 to $1000 to the right person (Kelly Blue Book priced it at $1355 to a private party and $255 as trade-in to a dealer). The engine was completely rebuilt in 2016 and it also had four new tires. So $90 was unacceptable to me, but I thought the dealership was bluffing.

Peter asked what new car I might be interested in, and I said the standard Honda Fit.

“How would you like to take that Fit for a test drive?” Peter said, pointing to a red one parked conveniently outside the side door. After driving it around Groton for 15 minutes, I returned to Peter’s oval negotiating table.

“Here at Cardinal Honda we do things the right way,” Peter began. “We don’t fool around. We have something called ‘the clear and simple’ price. Other dealerships will tell you one price and then negotiate down to another price. We don’t do that. We give you the ‘clear and simple’ price right away. That’s how we operate at Cardinal Honda. The right way.”

“What’s the price of the car?” I asked.

“On that 2017 model,” he continued, “the dealer price is $16,800 and the ‘clear and simple’ price is $16,625.” He reiterated that Honda was still offering an “incredibly low interest rate” of 0.9 percent on new cars.

I nodded and said that the only reason I was in the market for a new car was because I wanted to use the old Subaru as a trade in. If they couldn’t do a trade in for a better price than $90, then it didn’t really make sense to me to buy a new car from them — perhaps I should go to another dealership that could offer a better value. Peter nodded and basically said, “good luck with that.”

I asked about used cars, and Peter took me outside to see two 2013 Fits, each priced at around $12,500, which seemed like a slim discount on the new vehicle. As we stood outside standing in a rainy drizzle, Peter asked what I was thinking. I said that if he was able to bring the price of a new car down to $16,000 with the trade in, then I would be interested in it. He told me he’d try his best by calling around to find a better trade-in price for the Subaru. I told him that I’d check back with him after running errands.

Hours later when I returned, Peter said he could go up to $300 on the trade-in for the Subaru, bringing the price of the new Fit down to $16,325. I said it was still high. Peter asked me to wait a moment while he discussed it with his floor manager.

I sat waiting for 10 minutes, staring out the dealership’s big glass window at my old Subaru sitting in the parking lot. In my negotiations class, I am learning about how one can leverage his or her BATNA, or “best alternative to a negotiated agreement,” which for me in this case was sticking with the old Subaru rather than buying a new car. My BATNA seemed pretty decent, which gave me emotional leverage for the negotiations — at no point did I feel forced into a deal. Looking at the Subaru, I thought: ‘It’s not such a bad car after all. It just needs a little love.’

Peter returned with Tim, and they took seats on either side of me, which felt like another intimidation tactic. Tim said he could split the different between $16,325 and $16,000 and go to $16,162.50. I said thanks but that it was still higher than I wished to pay. Peter then piped in to offer an extra oil change for free. I again said thanks and that I would think about their offer, but that I would shake on $16,000 right then.

“Stephen, we’re putting our best foot forward here,” Tim said. “In a negotiation, both sides give up something. That’s how it works.”

“Well, I feel like I already have given up a lot!” I said. “I wanted $1000 for that Subaru, and you’re asking me to take $300. Maybe I came in with an unrealistic expectation, but that’s the value that I see in the Subaru, which works for me. It runs OK. Thank you for offering to split the difference on the price, Tim. And Peter, thank you for throwing in the extra oil change. I guess you’re looking for me to give something, now? What if I said $16,050?”

“Stephen, we don’t have time to nickel and dime. We’re trying our hardest to make a deal. We’re not making anything on this sale right now, it’s about break-even for us. We’re doing this for you. Are you now going to take the $16,162.50?”

“I’ll have to think about it,” I said.

They looked at each other, nodded, stood up and walked away. I called Peter’s name. He walked back.

“Peter,” I said, “that seemed to end a little awkward. Is everything OK?”

“Stephen, we’re working our hardest to find a deal that will work for you. Let me know if we can do anything else.”

I said thanks and left. Driving away, I felt no regrets for walking away from their deal, and instead started to feel miffed that they had accused me of nickel and diming them (!), after they had miraculously increased the trade-in value of the Subaru to $300 (compared to $90 initially) and had also knocked down their “clear and simple” price by $162 and five dimes (or 10 nickels). They were literally nickeling and diming me.

That night I went home and saw the following email waiting from Peter:

Just finished working with you and you know your trade difference is at $16,162 with me giving you an extra free oil service. Hope to earn your business. Thankyou

I responded to him:

Thank you for making the time for me today, and for working on the trade-in price. I’d also like to give you business. So, let’s do it for $16,000! 🙂 You know my dad and how loyal he is to Cardinal Honda in always bringing his truck to you for oil changes and other services. In me, you’re not just gaining a sale but also a new customer. Here’s an idea: What if I forwent the free oil services? By me giving up both the first oil service and the extra service that you generously added, could we bring the trade difference down to $16,000?

Peter responded in the morning:

Hi Steve, working on it. I’m off today but trying to make it happen.

Peter soon followed up with:

Hi Steve, got it done for you. Trade difference $16,000.

“Hot damn!” I thought, “I’m getting a new car!” It seemed that my walk-away tactic had worked, especially at the end of the month when dealerships are under more pressure to close deals and hit their target sales numbers. The previous day I had been willing to pay $16,050, and now I was paying $16,000.

Then came the most unbelievable and frustrating part of the ordeal. I called the dealership to finalize a down-payment and financing plan, and a man named Chris asked me what kind of loan I’d like to take out.

“I’ll do whatever terms are necessary to get the sub-1 percent financing.”

“Sub-1 percent?” Chris asked. “We don’t offer that. The rate now is 3.44 percent.”

“What?! I was told from the beginning that you did. This entire deal was based on the premise that you offered that low interest rate.” At that higher rate, my payments over the lifetime of the loan would be an extra $500.

I emailed Peter:

Chris just told me that the sub-1% financing is no longer available on the Fit — this is a real disappointment! He’s calling me back soon to work through the numbers. Any idea if there’s still a way to get that lower financing?

Peter called me to apologize that the old financing was not available — somebody had made a mistake on the numbers that month — but he added that he still thought it was a good deal for me. I pointed out that I was basically being asked to pay $500 more than I was initially told I would have to pay, and that this was a deal-breaker for me. The only way to salvage the deal would be if the dealership somehow made up that $500 on the price of the car. Peter said there was absolutely no more wiggle room on the price.

He asked: “Are you really willing to walk away from this offer, Stephen?”

“Yes, Peter, I think that I have to,” I said.

“Well, thank you and good luck,” he said.

Soon after hanging up, I shot off the following email in an attempt to lay the guilt on Peter for what had happened:

At least now you know that 0.9% financing is no longer available on the Fit models. I feel like I should be more frustrated about this confusion on the financing terms, which we spoke about very early into our meeting yesterday. But I think you made an honest mistake and that you still worked to get a good deal for me. If better terms become available, you certainly know how to reach me. -Stephen

Within the hour, Chris called me back and said, “We found another $275 to take off the price.”

I couldn’t believe it. They’d “found” another $275? Like it was just hiding inside the glove compartment? I responded to Chris, “Great. Now if you can find an interest rate low enough below 3.44 percent to make up for the rest of the $500 difference, then I will be back at the table.”

At about 4:30pm, a half-hour before my insurance agency closed for the weekend and threw a whole new wrench in the deal, Chris called back to say he’d secured a 2.2 percent interest rate with a local bank. I said we had a deal.

In the end, Cardinal Honda had slowly chipped more than $1,000 off the price of the car in a progression that looked like this:

- $16,800

- $16,625

- $16,535 (including $90 trade-in value for Subaru)

- $16,325 (including $300 trade-in value for Subaru)

- $16,162.50 (including $300 trade-in value for Subaru and extra oil change)

- $16,000 (including $300 trade-in value for Subaru)

- $15,725 (including $300 trade-in value for Subaru)

Cardinal Honda was buzzing with activity when I returned to sign all the paperwork, dozens of customers chatting with salesmen and sitting at negotiating tables, being told that they were getting the “clear and simple” treatment. In my experience, it was anything but “clear and simple.”

I love my red Honda Fit. Thing is, I have to wonder how much money I left on the table. After all the wheeling and dealing, it seems like the dealership always had an ace up its sleeve. The process felt kind of like gambling: No matter how much you may think you won, in reality, the House always wins.

Postscript:

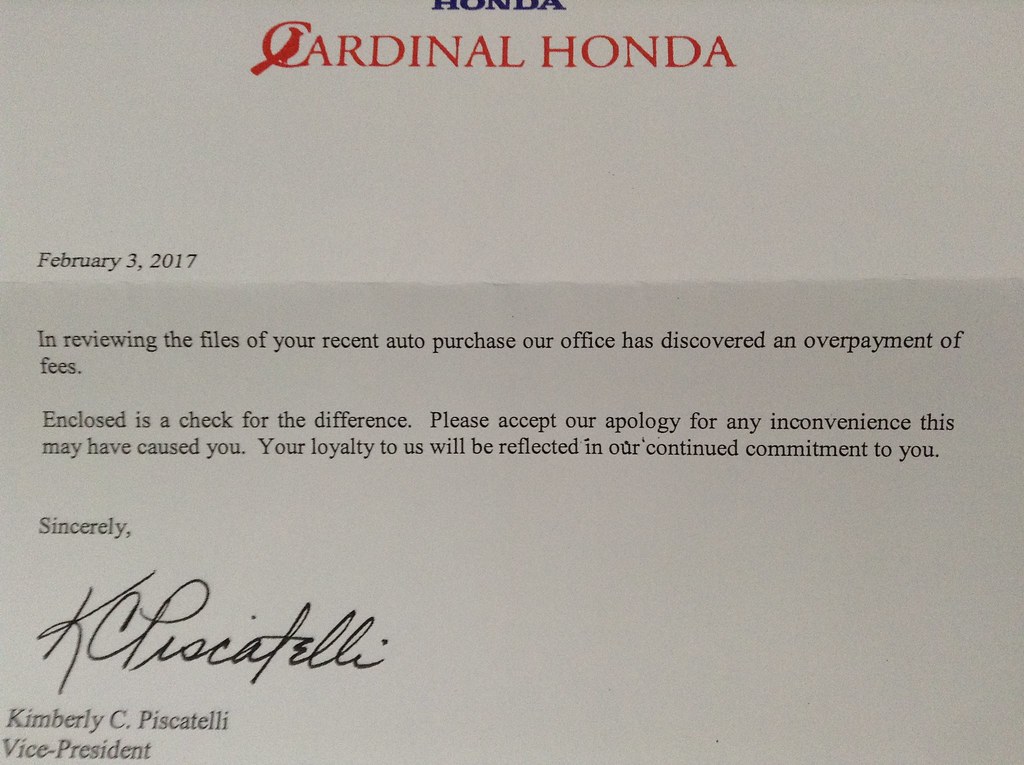

Two weeks later, I received a letter in the mail from Cardinal Honda. The dealership said it had overcharged me $15 for “fees” and was giving me a refund check. Should I feel reassured by the meticulous bookkeeping implied in this $15 check? Or is it just another manipulative tactic to make me feel I got the “clear and simple” price?